quicken tax planner problem

Click the Add Paycheck button. That can be painful if your finances are scattered across 12-months of statements from your bank credit cards mortgage company and so on.

401k Scheduled Deductions In Tax Planner Quicken

That being said if the software turns to garbage with inabilities for downloads to work and inaccurate calculations then whats the point.

. In 2019 the pricing for various models of Quicken is as. It is common for some problems to be reported throughout the day. This chart shows a view of problem reports submitted in the past 24 hours compared to the typical volume of reports by time of day.

Quicken will list the most recently opened files so you can access and switch between them from the File menu. Up to 5 cash back March 15 was the due date for taxes until 1955. Click Show Tax Planner.

Run expense reports tax schedule reports. Specifically its not saving Scheduled Bills and Deposits under Other Income or Losses Its also not saving Scheduled Bills and Deposits under Withholdings. Click the File menu.

Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner. For example the Subscription Release of Quicken is currently in 2022 so its Tax Planner supports calculations for tax years 2022 and 2021. Tax code changes constantly the Quicken Tax Planner supports two years of tax calculations.

If you didnt do that its okay. You can not lump all rental properties into a. Im using the Paycheck form feature and have the pretax retirement contributions in the proper area and the taxable income at the bottom of the form seems to be.

These Tax Relief Companies Can Help. Select Accounts window not showing Capital Gains Estimator Tool It was verified to be an issue by Quicken Tyka see attachment. The new model means that you automatically get updates when you renew your membership but it also means that you have to pay each year.

How to switch back to your main data file. If you use that versions Tax Planner in 2022 Quicken displays your current. If youre living and working outside the US you have until June 15 to file.

The Tax Planner doesnt account for the fact that taxes are only due on 85 of the Social Security benefit. For some reason I cannot get the Tax Planner to save certain settings. Because the US.

Select the data file you want to open. Updated the W4 tax rates and mileage rates in the Tax Planner. Overview If youre unable to open Quicken for Windows after a recent product update its possible that an issue during the installation is preventing Quicken from opening.

In 2016 the date is Monday April 18 for personal returns as well as for C corporation and estate returns. To set up a new paycheque click the Planning tab then click the Tax Centre button if it isnt already open. I havent found anything that includes an integrated Tax Planner and Lifetime Planner.

You can manually enter projected amounts for information you choose not to track in Quicken remember to enter a full years worth and you can edit any amounts that Quicken has filled in for you. Any tax planner data fields for which no quicken data is available are reset to zero. If you use TurboTax you can import your mileage from Quicken directly into TurboTax.

April 15 has been the deadline since then. Quicken outages reported in the last 24 hours. Click the Tax Center button.

There appear to be two problems. Click the Planning tab and then click the Tax Center button. I reported a problem with the Capital Gains Estimator in Quicken for Windows Canadian Version.

Whether you use tax preparation software or work with an accountant knowing what you can claim on your taxes can help you plan for the upcoming tax year and minimize your tax burden. Ad Owe Over 10K in Back Taxes. Click the Planning tab.

Click Add Paychequ e then enter the information Quicken requests. Even working with a tax professional youll still need to fill out a comprehensive tax planner at the end of the year. The current year and the year prior.

Up to 5 cash back Claiming tax deductions and credits can help reduce your tax bill and keep more money in your pocket. Downdetector only reports an incident when the number of problem reports is significantly higher than. Im using the Paycheck form feature and have the pretax retirement contributions in the proper area and the taxable income at the bottom of.

The Tax Planner still uses 10 of AGI as the exclusion from itemized deductions for Medical and Dental expenses. The op does not seem to realize that a given Schedule E report can only be for a single property. It seems that the op has already created property tags.

Quicken has been having problems for many years now. Has it been resolved in the upcoming Canadian Quicken Windows. An issue where a subscription alert message could still display immediately after the subscription was renewed due to a timing problem with alerts.

Tax Relief Help Help With IRS Back Taxes 2022 Top Brands Comparison Online Offers. The actual 2020 Schedule A uses 75 of AGI for the exclusion. Youll find it below the.

In Budgeting and Planning Tools Windows The Quicken for Windows Tax Planner substantially overestimates the income tax that I will owe to the IRS. To edit all future paycheques of a paycheque youve already set up choose Tools menu Manage Bill Income Reminders List find the paycheque in the list then right-click the paycheque name and. Look near the bottom of the option list.

Set your filing status tax year and scenario. Partnerships and S corporations have a deadline of March 15. There is no end date option in the Paycheck tracker reminder.

An issue where the new status blue icon of a transaction was not cleared after the transaction was edited. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner. Here is a list of 10 tax deductions credits and tactics.

Quicken can help you adjust your year-to-date totals using the Paycheck wizard. It is my Social Security Paycheck tracking reminder that is not projected properly in the Tax Planner. In Budgeting and Planning Tools Windows Good morning.

Quicken will list the most recently opened data files with a check mark next to the file. Youll get the most out of the tax tools in Quicken such as the Tax Planner by setting up your paycheck at the beginning of the tax year. Property Tags are created by Adding a Property in the Rent Center Properties and Tenants Add Property on the Rental Property tab.

I use Quicken Premier and Im on release 2314. Even before being spun off into an independent company.

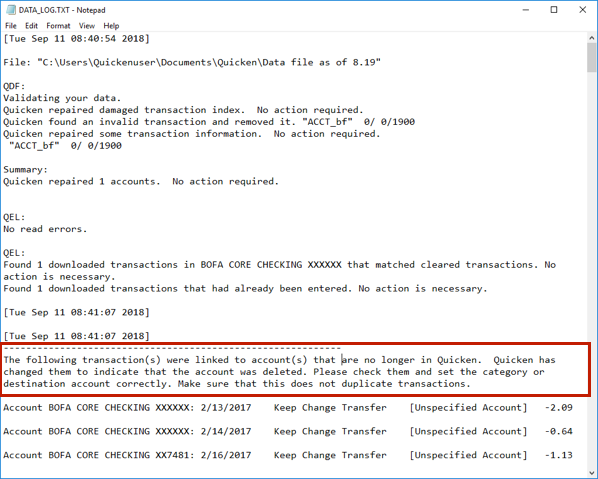

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Tax Planning Meetings With A Skilled Expert Will Enable You To Get Tax Reduction Or Tax Exemption As P Business Loans Loans For Bad Credit Bookkeeping Services

How Debt Consolidation Works Personal Loans Emergency Fund Money Management

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Pin By Erica Thomas On Sameer Managing Your Money Quicken Better One

Quicken 2019 For Mac Review Robert Breen

Quickbooks Missing Name List Problem Quickbooks Name List Names

Get Quicken Support From Quicken Support Phone Number Live Quicken Support Number Help By Quicken Phon Tax Software Best Tax Software Online Accounting Courses

Quicken Customer Support Number 1 800 201 4179 Quicken Helpline Quickenhelpsuport Com Over Blog Com Quicken Financial Management 1 800

Pin On Quicken Helpline Number

Estimated Tax Math In Planner Seems Incorrect Quicken

Quicken Update Fails Quicken Update Not Working How To Fix Quicken Errors Solution

Blog Page 6 Of 19 Currace Quicken Words Containing Quickbooks

Amazon Com Quicken For Windows The Official Guide Eighth Edition Quicken Guide Ebook Sandberg Bobbi Kindle Store

Quicken Premier Review Top Ten Reviews

How To Fix Quicken Error Cc 506 Quicken Technical Glitch Financial Institutions

Another Tax Planner Issue Question With Wages Quicken

Tax Planner Other Withholding Using Wrong Total Quicken

How I Learned To Love Quicken Deluxe And Give Up On The Past Tidbits